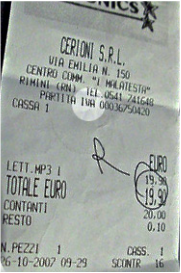

Note the "IVA" indicated in the circle--the tax is included in the purchase price Note the "IVA" indicated in the circle--the tax is included in the purchase price When shopping in Italy, or any country in the EU, you will always be paying the VAT (Value Added Tax), or, as it's called in Italy, the IVA. Look at the bottom of your Italian shopping receipt and you'll see the tax line item for the IVA. Keeping track of these receipts--and the tax you paid for your purchases--could save you money the next time you travel in Italy. All European Union have a VAT that they levy on purchases, with each country setting its own rate. The VAT rate in Italy is currently at 22%, and will rise to 24% in 2017. The tax is applied to travel expenses, meals, and merchandise. As you can see, that 22% can really start to add up. The good news is that if you are not a resident of the EU, you can get some of that VAT money back. You see, tourists aren't obliged to pay the tax, but because the VAT/IVA is incorporated into the price of nearly everything you purchase, the tax is simply part of the purchase price... the only way to get it back is filling out forms, and following the somewhat complex rules. What Purchases Qualify for a VAT Refund in Italy? First, you cannot get a refund on the tax on accommodations or food in Italy. There is an exception when traveling for business in Europe, but we won't get into that here. Any other purchases you make in Italy where you see the “IVA” added, are eligible for a VAT refund at the end of your vacation, including souvenirs, ceramics, clothing, jewelry, leather and even some services. Keep in mind that there’s a minimum amount required in order to claim an IVA/VAT refund--currently in Italy the minimum purchase amount to submit a VAT refund is €154.94--all spent in one store at one time. So, for instance, if I want to buy an Italian guitar while in Italy, this would fit right in. It would also work when buying ceramics in a single shop Vetri Sul Mare on the Amalfi Coast--a town with many ceramics craftsmen (but won't work if buying a few things in several different shops). There are many interesting and unique shops in Rome, Venice or Florence that have a wide array of gifts perfect for the Voyager--either for yourself or gifts for loved ones back home. Planing your shopping sprees in shops that have a wide array of products is a great way to make purchase in one shop beyond the €154.94 minimum. Other rules also need to be followed:

There are actually many merchants that will instantly remove the IVA tax as soon as you show them your Non-EU passport. Use your passport as leverage, making them believe you won't make the purchase if they won't remove the tax amount. This is one way to circumvent the entire refund process. But many vendors simply don't want to bother with the paperwork on their end. Keep in mind, however, that even if the merchant is willing to take the VAT amount off the purchase price, you’ll still need to get the receipt stamped at customs before you leave the country. Keep your receipts with each item purchased. How to Get a VAT Refund in Italy Here's why many people don't even bother about getting a refund--it can be a real hassle. First, you need to ask the vendor about getting a VAT refund before leaving the shop. They need to give you a separate receipt--a copy known as a fattura--in addition to the one that comes out of the cash register. The fattura should include your name (use your passport as I.D.) and the amount of the IVA/VAT tax for the purchase. If there are blanks on the “fattura” for you to fill out, ask what information you need to fill in. Keep all forms and receipts, including the additional “fattura” receipts, in a secure place. Ok... now part requires extra time at the airport when leaving Italy: Gather together all your purchases (a soft, collapsible duffle works well for smaller carry-on purchases that might be fragile or valuable), along with their respective receipts and forms and then bring them to the local customs office at the airport. When it’s your turn at the front of the special customs line, you’ll present all your receipts (and your purchased goods for inspection, if that’s required) and they’ll stamp everything. You then need to get those stamped receipts back to the merchant where you initially purchased the items. Yes--believe it or not. Many bigger stores work with companies with branches at airports and other international gateways in Italy (Global Refund and Premier Tax Free are two of the most common), which means you’ll need to take your stamped receipts to the appropriate agency’s office in the airport in order to get a refund on the VAT. You’ll either get a refund in cash right then, or they’ll refund your credit card. They take a small cut of the total amount. If, on the other hand, the merchant from whom you made your purchase doesn’t work with one of those in-airport agencies, then you’ll need to mail your receipts back to them directly, either from the airport before you leave or from home. I know what you're thinking... That you may never hear from the merchant again and never see a refund anyway. This is possible, but many shops are fairly honest and will honor the request for a VAT refund. You might get a refund sent to you in Euros, requiring a fee for converting to dollars again. Complicated, right? This is why many people forget about VAT refunds. It is a real hassle. Of course, this is even more incentive to use your Passport as leverage when making the original purchases... try really hard to get them to take the VAT off voluntarily, or you won't buy. It does work.  How Do I Avoid All This Hassle? The best way to avoid the hassle is to shop in stores that display a Tax Free Shopping or Euro Tax Free sign in their window. There are enough shops with this logo displayed in the larger Italian cities to satisfy your shopping needs. In these Tax Free Shopping stores, you’ll need to show your passport when you make your purchase, and they will give you a check for the VAT amount along with the receipt for the goods. When you get to the airport, you’ll need to go to the line at the customs office for VAT refunds and have your receipts stamped, and then take the receipts--along with the check the merchant gave you--to the “Tax Free” booth in the airport where they’ll give you cash for that check. These booths are typically near the airport’s Duty-Free Shop. That's a bit easier, right? Steps & Tips for Getting a Refund

Remember: Incomplete Tax Free Form = No refund

Remember: No Customs Stamp = No Refund

The refund you receive is the VAT minus Global Blue’s service fee.

Additional Tips

Tax Free Shopping Card... No need to fill in paperwork in shops! Ok, so after going through all of the above, here's an even simpler way to do some tax free shopping in Italy... Whether you’re a frequent international shopper or planning a special trip abroad, you can easily save both time and money when you shop tax free with the new Shop Tax Free Blue Card. Membership is free! The Shop Tax Free Blue Card allows you to claim your tax savings without the hassle of filling in Tax Free Forms by hand in busy shops each time you buy something. With a swipe of your card all your details will automatically be filled out on your Tax Free Form which is then printed out for you by the sales assistant. In this way, language communication problems and mistakes are avoided and you save time and money for a more convenient and enjoyable Tax Free Shopping trip. Global Blue works with around 270,000 stores worldwide so you can enjoy the benefits at participating shops and take advantage of member only promotions. LINK: Shop Tax Free Blue Card sign-up There's an App for Tax Refunds The Global Blue App from Google Play (for Android) and iOS (for iPhone and iPad) connects travelers to the world of Tax Free Shopping with just one click. Global Blue’s app will guide travelers to the very best stores in many European cities, with full contact details and interactive maps. You can search the app for stores by location, product or brand. The Global Blue App also helps a shopper to figure out their savings with the Tax Refund Calculator and step-by-step instructions on how to complete the Tax Free Shopping service. A re-engineered Refund Tracker is coming soon. Do a search in your favorite app store on Global Blue. So, there you have it... a fairly intensive introduction to getting your VAT taxes refunded in Italy. For more information: Global Blue Q&A

--Jerry Finzi You can also follow Grand Voyage Italy on: Google+ StumbleUpon Tumblr Copyright Jerry Finzi/Grand Voyage Italy - 2016

11 Comments

Kathy Schwab

11/23/2017 01:58:16 pm

I purchased some leather goods in 2 different shops in Florence, Italy in September. Both shops gave me a form to fill out and take to the airport to have the Customs Agent stamp and then mail. I was able to leave one of the forms with a person near the Duty Free shops, but the other one had to be mailed, and I think it was to somewhere in Ireland. Unfortunately I never recorded any of the numbers from these forms. I just checked my MasterCard statement, and as of November 20th, I have now been charged $141.91 CDN with a line that says "Tax Refund Rejected Premier Tax FIRL 91.73 EU".

Reply

Felix

4/3/2018 01:23:04 pm

Kathy,

Reply

Jerry

4/4/2018 11:08:34 am

Kathy,

Reply

6/13/2018 05:39:52 pm

Thank you very much for keep this information.

Reply

I was in Sienna on a bus tour with my wife. She purchased a purse from a a high end shop. Unfortunately we both left our passports back at the hotel. The vendor told us to just show the tax refund office at the airport the receipt and we could fill out the paperwork to get the VAT back. No such luck. They told us we needed the paperwork from him. Is there any other way I could submit a form to the government for a refund

Reply

Jerry F.

9/20/2018 03:25:29 pm

Mike,

Reply

Laura KRIAUCIUNAS

9/24/2018 03:06:58 pm

Dear Jerry,

Reply

Gail Udemans

8/13/2019 03:18:54 am

I spent Euro 340 on shoes at Gilardini in Florence which included Euro 61.31 in tax and Global Refund Portugal only refunded Euro 42-00 from which they deducted a Euro 3-00 service fee so I only received Euro 39.00.

Reply

Claudio and Mary Cavalieri

10/25/2019 11:49:56 am

Hi we live in Canada and we purchased some items. We received the Global Blue envelope when we were in Italy but we do not have a form to fill out. We do have all our bills. The envelope says to write our credit card number and mail it. However I don't have a form. What should I do?

Reply

Felix

10/27/2019 05:08:38 am

Mary,

Reply

3/5/2023 12:17:14 pm

Cool article about the tax rate in Italy, how it's applied, and how keeping track of receipts could help save money in the future. Additionally, the text notes that non-EU residents can get some of the VAT money back, but that the process can be somewhat complex.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Categories

All

Archive

June 2024

|

RSS Feed

RSS Feed